Read each statement below, indicate if it is true or false, and give a brief explanation of your answer.

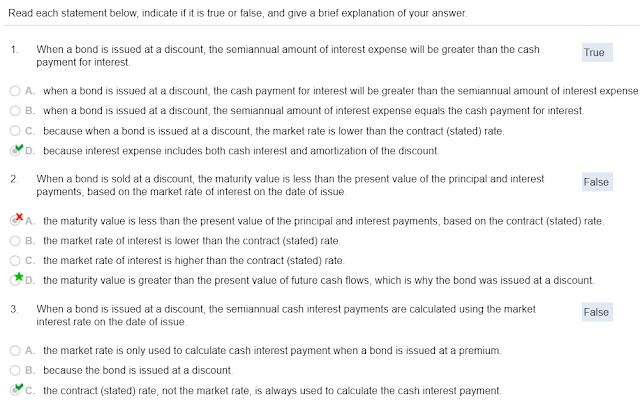

1. When a bond is issued at a discount, the semiannual amount of interest expense will be greater than the cash payment for interest. True

A.

when a bond is issued at a discount, the cash payment for interest will be greater than the semiannual amount of interest expense.

B.

when a bond is issued at a discount, the semiannual amount of interest expense equals the cash payment for interest.

C.

because when a bond is issued at a discount, the market rate is lower than the contract (stated) rate.

D.

because interest expense includes both cash interest and amortization of the discount.

Your answer is correct.

2. When a bond is sold at a discount, the maturity value is less than the present value of the principal and interest payments, based on the market rate of interest on the date of issue.

False

A.

the maturity value is less than the present value of the principal and interest payments, based on the contract (stated) rate.

Your answer is not correct.

B.

the market rate of interest is lower than the contract (stated) rate.

C.

the market rate of interest is higher than the contract (stated) rate.

D.

the maturity value is greater than the present value of future cash flows, which is why the bond was issued at a discount.

This is the correct answer.

3. When a bond is issued at a discount, the semiannual cash interest payments are calculated using the market interest rate on the date of issue. False

A.

the market rate is only used to calculate cash interest payment when a bond is issued at a premium.

B.

because the bond is issued at a discount.

C.

the contract (stated) rate, not the market rate, is always used to calculate the cash interest payment.

Your answer is correct.

D.

the contract (stated) rate is used to calculate the present value of the future cash flows from the bond.

4. When a bond is sold at a discount, the cash received is less than the present value of the future cash flows from the bond, which are based on the market rate of interest on the date of issue. False

A.

the discount amount equals to the difference between the cash received and the present value of the future cash flows.

B.

the cash received is equal to the present value of the future cash flows discounted at the market rate of interest on the date of issue.

Your answer is correct.

C.

because the market rate of interest is used when calculating the present value of the future cash flows.

D.

the cash received is more than the present value of the future cash flows.

5. When the year-end accrual of interest and amortization of discount is recorded, the carrying value of Bonds Payable on the balance sheet will increase. True

A.

as the balance in the discount account increases (as it is amortized), the carrying value of the bonds increases.

B.

as the balance in the discount account decreases (as it is amortized), the carrying value of the bonds increases.

Your answer is correct.

C.

as the balance in the discount account decreases (as it is amortized), the carrying value of the bonds decreases.

D.

as the balance in the discount account increases (as it is amortized), the carrying value of the bonds decreases.

6. The amortization of the discount on a bond payable results in additional interest expense recorded over the life of the bond. True

A.

the discount is amortized to interest expense over the life of the bond, the discount is actually additional interest expense that has to be paid because the bond's contract rate was more than the market rate on the bond issue date.

B.

the discount is amortized to interest expense over the life of the bond, but the discount actually decreases the interest expense that has to be paid because the bond's contract rate was less than the market rate on the bond issue date.

C.

the discount is amortized to interest expense over the life of the bond, the discount is actually additional interest expense that has to be paid because the bond's contract rate was less than the market rate on the bond issue date.

Your answer is correct.

D.

the discount is amortized to interest expense over the life of the bond, but the discount actually decreases the interest expense that has to be paid because the bond's contract rate was more than the market rate on the bond issue date.

1. When a bond is issued at a discount, the semiannual amount of interest expense will be greater than the cash payment for interest. True

A.

when a bond is issued at a discount, the cash payment for interest will be greater than the semiannual amount of interest expense.

B.

when a bond is issued at a discount, the semiannual amount of interest expense equals the cash payment for interest.

C.

because when a bond is issued at a discount, the market rate is lower than the contract (stated) rate.

D.

because interest expense includes both cash interest and amortization of the discount.

Your answer is correct.

2. When a bond is sold at a discount, the maturity value is less than the present value of the principal and interest payments, based on the market rate of interest on the date of issue.

False

A.

the maturity value is less than the present value of the principal and interest payments, based on the contract (stated) rate.

Your answer is not correct.

B.

the market rate of interest is lower than the contract (stated) rate.

C.

the market rate of interest is higher than the contract (stated) rate.

D.

the maturity value is greater than the present value of future cash flows, which is why the bond was issued at a discount.

This is the correct answer.

3. When a bond is issued at a discount, the semiannual cash interest payments are calculated using the market interest rate on the date of issue. False

A.

the market rate is only used to calculate cash interest payment when a bond is issued at a premium.

B.

because the bond is issued at a discount.

C.

the contract (stated) rate, not the market rate, is always used to calculate the cash interest payment.

Your answer is correct.

D.

the contract (stated) rate is used to calculate the present value of the future cash flows from the bond.

4. When a bond is sold at a discount, the cash received is less than the present value of the future cash flows from the bond, which are based on the market rate of interest on the date of issue. False

A.

the discount amount equals to the difference between the cash received and the present value of the future cash flows.

B.

the cash received is equal to the present value of the future cash flows discounted at the market rate of interest on the date of issue.

Your answer is correct.

C.

because the market rate of interest is used when calculating the present value of the future cash flows.

D.

the cash received is more than the present value of the future cash flows.

5. When the year-end accrual of interest and amortization of discount is recorded, the carrying value of Bonds Payable on the balance sheet will increase. True

A.

as the balance in the discount account increases (as it is amortized), the carrying value of the bonds increases.

B.

as the balance in the discount account decreases (as it is amortized), the carrying value of the bonds increases.

Your answer is correct.

C.

as the balance in the discount account decreases (as it is amortized), the carrying value of the bonds decreases.

D.

as the balance in the discount account increases (as it is amortized), the carrying value of the bonds decreases.

6. The amortization of the discount on a bond payable results in additional interest expense recorded over the life of the bond. True

A.

the discount is amortized to interest expense over the life of the bond, the discount is actually additional interest expense that has to be paid because the bond's contract rate was more than the market rate on the bond issue date.

B.

the discount is amortized to interest expense over the life of the bond, but the discount actually decreases the interest expense that has to be paid because the bond's contract rate was less than the market rate on the bond issue date.

C.

the discount is amortized to interest expense over the life of the bond, the discount is actually additional interest expense that has to be paid because the bond's contract rate was less than the market rate on the bond issue date.

Your answer is correct.

D.

the discount is amortized to interest expense over the life of the bond, but the discount actually decreases the interest expense that has to be paid because the bond's contract rate was more than the market rate on the bond issue date.